I. BACKGROUND

Company History

In the early 1990s, friends Arkady Volozh and Ilya Segalovich started to develop algorithms and search software. In 1993, they developed a Russian-language based search engine and named it “Yandex,” derived from the phrase “Yet Another iNDEXer.” Yandex quickly became one of the leading search engines in Russia and, in the early 2000s, started to expand into other products, including advertising services. After surpassing Google’s search engine in the Russian market, Yandex’s Dutch parent company, Yandex NV (“YNV”), went public on NASDAQ under the ticker YNDX. Thereafter, Yandex further expanded its services to include areas such as maps, e-commerce, music-streaming, and ride-hailing. Yandex (often referred to as “Russia’s Google”) was also an early innovator in the artificial intelligence (“AI”) and machine learning areas.

Ukraine War

Trading of Yandex shares on U.S. exchanges was suspended in February 2022 after Russia began its military operation in Ukraine. As of the last day of trading (2/25/22), Yandex was trading for $18.94/share, giving the company a market capitalization of $6.63bn. At the time, Yandex’s largest shareholder was a family trust established by company co-founder Arkady Volozh (~8.5% economic interest and 45.1% voting interest). Although shares of Yandex were suspended on U.S. exchanges, they continued to trade freely on the Moscow Stock Exchange. Unlike many other major Russian companies that were ultimately delisted from NASDAQ, YNV (the Dutch parent company) maintained its suspended listing while it negotiated to secure an exit from Russia whereby it could decouple from Yandex’s Russian operations.

Subsequent Developments

In February 2024, YNV, entered into a definitive agreement with a purchaser consortium to sell all of the group’s businesses in Russia and certain international markets (“RussiaCo”) at a deeply discounted valuation of $5.4bn, payable in a combination of cash and Class A shares of YNV. On July 15, 2024, YNV sold the remaining minority stake of 28% in RussiaCo for $180mm and ~94.9mm YNV Class A shares. The final total cash consideration was $2.8bn.

After the sale of RussiaCo to the consortium, YNV delisted its Class A shares from the Moscow Exchange and RussiaCo sought an independent public listing of its own in Moscow.

II. NEBIUS

Overview

Following the completion of the sale transaction, YNV was renamed Nebius Group and retained a portfolio of international business and other non-Russian assets, including four early-stage technology businesses. Securing capital for the advancement of its early-stage businesses had historically been challenging due to the inability of YNV to transfer profits from its Russian businesses. To support the development of these businesses in the future, Nebius has retained a portion of the cash consideration received.

Nebius AI

As the core of Nebius Group, Nebius AI operates one of Europe’s largest GPU cloud platforms. It provides “compute-as-a-service,” renting graphical processing units (GPUs) to companies for computationally intensive tasks like machine learning, algorithm development, and AI model training. Competing directly with hyperscalers and startups like CoreWeave, a U.S.-based alternative cloud provider that is reportedly seeking a $35 billion valuation in an expected 2025 IPO, Nebius is quickly gaining traction.

By Q3 2024, Nebius AI accounted for two-thirds of Nebius Group’s total revenue. Its customer base expanded to over 40 managed clients, up from 30 in Q2, including additions from the Fortune 500. Nebius is also executing a $1 billion AI infrastructure investment plan ($400mm spent to date), which includes building a GPU cluster in Paris and expanding its Finnish data center.

Toloka AI

Toloka AI, founded in 2014 as part of Yandex, is a global crowdsourcing platform specializing in data annotation and AI development. It connects businesses needing labeled data for machine learning with individuals performing tasks like image annotation, transcription, and AI model evaluation. Now part of the Nebius Group, Toloka drives advancements in natural language processing, computer vision, and model fine-tuning by producing high-quality datasets. In Q3 2024, it was Nebius Group’s second-largest revenue contributor, with over 85% of its revenue driven by strong growth in generative AI projects.

Avride

Avride develops autonomous delivery robots and self-driving vehicles to transform urban logistics with efficient, sustainable solutions. Partnering with Uber Eats in Austin, it deploys robots for food delivery, with plans to expand to cities like Dallas and Jersey City. Originating from Yandex’s 250-member autonomous vehicle team, Avride leverages advanced AI, mapping, and sensor technology for precise navigation. Now under Nebius, the company is seeking out automakers (as capital partners) to scale globally.

TripleTen

TripleTen, formerly Practicum by Yandex, is an online education platform offering part-time bootcamps in fields like Software Engineering, Data Science, and UX/UI Design. Tailored for career changers, it combines flexible learning, real-world projects, and personalized career support. With a job placement guarantee or full tuition refund, it has become a trusted path into tech careers. In Q3 2024, TripleTen saw significant growth, with student enrollment and bookings tripling year-over-year and its course offerings expanding to six programs.

Outlook

Nebius Group aims to achieve $1 billion in annual recurring revenue (ARR) by 2025, driven primarily by the growth of its core AI infrastructure business, alongside contributions from its other ventures - Toloka, TripleTen, and Avride. The company plans to scale its GPU and data center capacity aggressively, deploying tens of thousands of NVIDIA GPUs, including cutting-edge H200 and Blackwell platforms. Nebius is expanding its Finnish data center to support up to 60,000 GPUs and launching new colocation facilities in Paris and Kansas City, the latter with a capacity of 35,000 GPUs.

Alongside infrastructure growth, Nebius will focus on acquiring and expanding its customer base, targeting GenAI labs and securing long-term contracts. The introduction of innovative services, such as Nebius AI Studio for model inference, will further enhance its appeal to AI developers. While Toloka will capitalize on GenAI demand, TripleTen will expand its educational offerings, and Avride will scale its autonomous delivery fleet, the core Nebius business is expected to dominate revenue growth. With a projected 2025 revenue of $500-700 million and a positive adjusted EBITDA, Nebius is on track to capture a multi-billion-dollar ARR opportunity in the medium term, which is contingent on executing its strategy and market dynamics.

III. INVESTMENT THESIS

Nebius Group presents a compelling investment opportunity in the rapidly growing AI infrastructure market. The company is well-positioned to capitalize on the AI megatrend, leveraging its technical expertise, strong leadership, and robust balance sheet.

Investment Highlights

Experienced Leadership with a Proven Track Record:

Nebius is led by Arkady Volozh, a visionary entrepreneur who previously co-founded and scaled Yandex into a $30 billion business, surpassing Google in the Russian market.

This experience and track record of success in the technology industry, combined with his commitment to AI innovation, instill confidence in Nebius's ability to execute its growth strategy.

Strong Market Position in a High-Growth Industry:

Nebius is one of the largest providers of GPU capacity in Europe, focusing on AI-centric cloud platforms for intensive AI workloads.

The company is capitalizing on the explosive growth of the global AI industry, projected to reach a total addressable market (TAM) of $260 billion by 2030, with a CAGR of +35%.

Robust Financials and a Solid Balance Sheet:

Nebius has a strong financial position with $2.3 billion in cash and no debt as of September 30, 2024.

The company's AI cloud platform business is demonstrating impressive growth, with revenue doubling every quarter and expected to increase at least fivefold in 2025.

Significant Growth Potential and Expansion Plans:

Nebius is investing heavily in expanding its GPU and data center capacity to meet the surging demand for AI infrastructure.

This expansion includes tripling the capacity of its Finnish data center, building new colocation facilities in Europe and the US, and securing access to the latest NVIDIA GPUs, including the H200 and Blackwell platforms.

Catalysts

CoreWeave IPO:

The potential IPO of CoreWeave, a key competitor in the AI infrastructure market, is expected to establish a benchmark valuation for the industry and attract significant investor attention to the sector.

Nebius's strong market position and growth trajectory should benefit from this increased investor focus and potentially lead to a re-rating of its stock.

Lack of Sell-Side Analyst Coverage:

The limited sell-side analyst coverage currently available for Nebius presents an opportunity for early investors to capitalize on the information asymmetry.

As more analysts initiate coverage and highlight Nebius's strong fundamentals and growth prospects, the company's valuation is likely to benefit from increased visibility and investor interest.

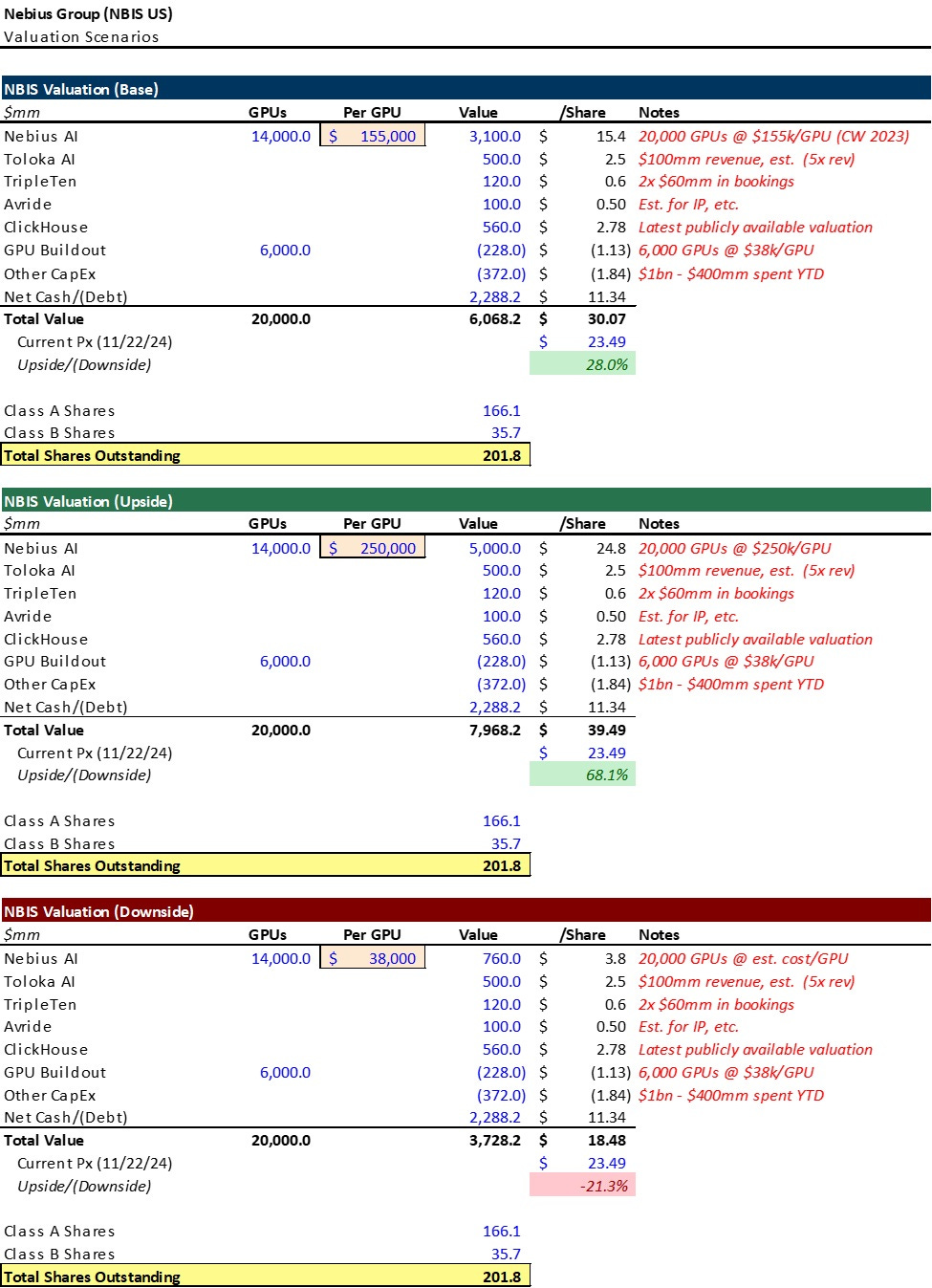

Valuation

Valuation metrics for early-stage cloud computing GPU companies like CoreWeave or Nebius are inherently challenging due to rapid growth, evolving markets, and unique operational dynamics. However, using CoreWeave’s earlier figures of a $7 billion valuation and 45,000 GPUs as a benchmark provides a useful (albeit conservative) reference point. This valuation implies an approximate value of $155,555 per GPU. Applying this to Nebius’s 20,000 GPUs suggests a potential valuation of around $3.1 billion. While such extrapolations are simplistic, they offer a rough framework for understanding Nebius’s value within the context of comparable companies.

Nebius Group’s combination of proven leadership, strong market positioning, and ambitious growth strategy positions it as a standout player in the AI infrastructure market. With significant investment in GPU capacity and expanding its data center footprint, Nebius is poised to capitalize on the surging demand for AI compute services, offering investors an opportunity to participate in one of the fastest-growing sectors of the global economy.

Disclaimer: The author does not guarantee the accuracy or completeness of any information provided. The author does not provide personalized investment advice and the information written is not tailored to the needs of any individual investor; everything written herein is the opinion of the author and is subject to change without notice. There is substantial risk of loss in the investments mentioned and you should consult with your financial advisor whether any investments suit your specific needs. The author may have positions in the investments mentioned and those positions may change without notice.

Excellent write up. Nebius will likely announce a fundraising with strategic investors; wonder if Nvidia will be part of the group