I. Executive Summary

NFE, an integrated ~$11bn EV “gas-to-power” company, is a global leader in developing LNG infrastructure and delivering cleaner, cost-effective energy solutions to underserved markets. With a presence in the Caribbean, Latin America, and other emerging markets, NFE is uniquely positioned to address the energy transition in regions historically dependent on costly, polluting fuels.

Despite near-term challenges, including an over-leveraged balance sheet and ambitious capital expenditures, NFE’s recent operational milestones, asset monetization initiatives, and planned strategic split between its upstream and downstream operations are strong catalysts to unlock shareholder value. The company’s Fast LNG (“FLNG”) technology, asset-level financing opportunities, and potential refinancing further bolster the equity story.

Investment Thesis

NFE equity offers asymmetric upside, supported by:

Imminent Cash Flow Inflection: FLNG1 is operational, with other projects nearing completion. These assets are expected to generate substantial EBITDA growth by 2025/2026.

Strategic Split: Management has announced plans to separate upstream and downstream operations, which could crystallize value for shareholders by improving operational focus and market visibility.

Asset Monetization: Sales of non-core assets in Puerto Rico, Brazil, and its Energos stake have improved liquidity and de-risked the balance sheet, with further asset-level financing opportunities.

Management Incentives: CEO Wes Edens’ significant equity stake aligns his interests with shareholders and provides confidence in the company's ability to manage financial pressures.

II. Background

A. Company History

(i) Early History

NFE was founded in 2014 when Florida East Coast Railway (“FECR”), a portfolio company of Fortress Investment Group (“Fortress”), successfully built a small LNG liquefier to reduce its reliance on expensive, dirty fuel oil. After completing the project for $70mm in under one year and saving the railroad ~25-40% of its fuel spend, individuals affiliated with Fortress formed a new venture, New Fortress Energy, to take ownership of the liquefier and diversify its customer base beyond FECR.

The critical component to NFE’s entire business model, and a key differentiator, is that NFE seeks to actively create end-market demand by investing in downstream infrastructure. NFE’s initial focus was on developing nations in the Caribbean, where the existing electricity supply was mainly derived from dirty diesel or heavy fuel oil. Although natural gas (delivered via LNG) is an obvious alternative for these regions, the infrastructure in the Caribbean was not set up to receive, distribute, or incorporate LNG into existing electricity grids; therefore, large incumbent LNG companies had historically overlooked the market opportunity.

NFE’s first major downstream project was a terminal in Montego Bay, Jamaica, which includes a moored Floating Storage Regasification Unit (“FSRU”) to supply power to Jamaica Public Service.

Beyond acting solely as a processor/supplier of LNG to power plants, NFE expanded further downstream in 2021 when it developed its 100MW power plant in La Paz, Mexico.

(ii) Expansion (M&A)

Although initially focused on downstream LNG terminals and power assets, NFE evolved into a significant LNG infrastructure player when it acquired Hygo Energy Transition (“Hygo”) and Golar LNG Partners (“GMLP”) in 2021 for ~$5bn.

The acquisition of Hygo, an LNG-to-power business, significantly expanded NFE’s footprint in South America and brought an operating FSRU terminal, a 50% interest in a 1500MW power plant in Sergipe, Brazil, and two additional development-stage FSRU terminals with 1200MW of power.

The acquisition of GMLP, which NFE already had an existing charter agreement with, significantly expanded NFE’s vessel fleet and brought six FSRUs, four LNG carriers, and a 50% interest in Trains 1 and 2 of the Hilli (a floating liquefaction vessel) into the NFE portfolio. In August 2022, NFE created a joint venture with Apollo Global Management (“Apollo”) called Energos Infrastructure (“Energos”), whereby it contributed vessels to the joint venture in return for ~$1.85bn of cash proceeds and a remaining 20% stake. In February 2024, NFE completed the sale of its remaining 20% stake in Energos to Apollo.

(iii) Recent

In late 2022, New Fortress Energy (NFE) stock reached an all-time high amid record European demand for LNG, driven by efforts to reduce reliance on Russian gas. By the end of the year, NFE realigned its capital allocation framework, announcing a $3/share dividend (~$600 million annually) and committing to distribute approximately 40% of adjusted EBITDA to shareholders.

The company's strategic acquisition of Golar LNG Partners (GMLP) brought intellectual property that underpins NFE’s transformative Fast LNG ("FLNG") technology. These modular floating liquefaction facilities significantly reduce costs and deployment times compared to traditional onshore facilities, enabling NFE to access untapped markets.

B. Business Model

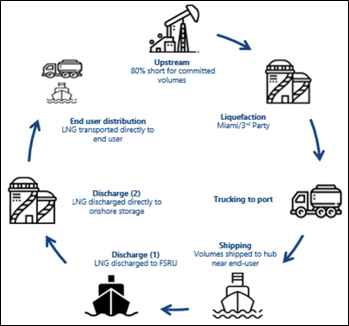

NFE’s business model spans the entire production and delivery chain from natural gas procurement and liquefaction to shipping, logistics, facilities, and conversion or development of natural gas-fired power generation.

(i). Terminals & Infrastructure

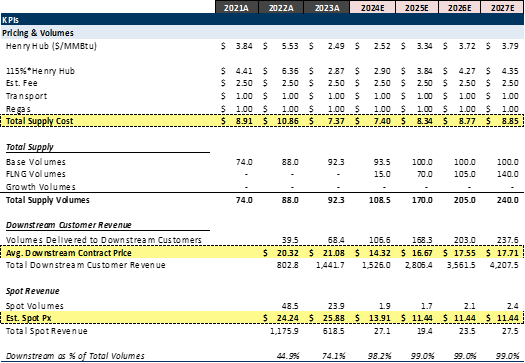

In its Terminals & Infrastructure segment, NFE primarily generates revenues by entering into long-term supply agreements with third parties for LNG and matching that supply with downstream demand. Some of the Company’s contracts are sold on a “take-or-pay” basis whereby the customer must pay for the minimum guaranteed volumes even if it does not take delivery. The price under these agreements is typically based on a market index plus a fixed margin. Due to these contracts' fixed price and volume nature, NFE can project out future revenues from these agreements. As of 12/31/23, NFE is expected to generate ~$14.9bn under its then-existing agreements.

In addition, NFE has historically been able to sell excess volumes on the spot market (especially when market pricing was attractive). NFE has recently secured management contracts with Puerto Rico to operate and maintain its thermal generation assets.

NFE currently has thirteen facilities that are either operational or under active development. The main cost drivers of supplying these downstream customers are: (i) procurement of feedgas/LNG and (ii) shipping and logistics costs to deliver LNG or natural gas to downstream facilities. Typically, the cost to acquire LNG is based upon a formula that takes into account the prevailing benchmark natural gas spot rate (Henry Hub) and adds in liquefaction and shipping charges.

(ii) Ships

NFE’s shipping assets include Floating Storage and Regassification Units (“FSRUs”), Floating Storage Units (“FSUs”), and LNG carriers (“LNGCs”), which are either leased to customers under long-term or spot arrangements or commercially operated by NFE.

FSRUs provide offshore storage and regasification capabilities and are generally less costly and substantially faster to deploy than land-based LNG regasification and storage facilities.

FSUs are floating storage assets that often store LNG but are also capable of transporting it when required.

LNGCs transport LNG and are compatible with many LNG loading and receiving terminals globally.

Vessels currently chartered to third parties are included in NFE’s Ships segment, whereas vessels operated at NFE facilities are included in NFE’s Terminals & Infrastructure segment. As third-party charter agreements roll-off, these ships will be included in the Terminals & Infrastructure segment.

C. Recent Operational and Capital Markets Updates

(i) FLNG Deployment Progress:

FLNG1, initially scheduled for deployment in 1H23, faced delays but achieved operational status in mid-2024. The unit, now fully operational offshore Mexico, has a capacity of 70 TBtu and is projected to contribute approximately $600 million in annual EBITDA. Construction of FLNG2 and FLNG3 is advancing, with deployment targeted for 2025.

(ii) Refinancing and Asset Monetization:

In early 2024, NFE raised $500 million in senior secured notes due 2029 to refinance a portion of its 2025 notes and announced that proceeds from further financings would support balance sheet optimization. In November 2024, the company completed an additional $1.2 billion refinancing, extending debt maturities to 2029 at a 12% interest rate. Simultaneously, NFE executed a successful $400 million equity offering, fully subscribed at $8.63 per share, reinforcing liquidity and demonstrating investor confidence.

(iii) Asset Sales and Liquidity Generation:

To further enhance liquidity and deleverage, NFE monetized non-core assets, generating over $500mm in proceeds during 2024.

Key transactions included:

Sale of Puerto Rico power plants to PREPA for $373 million.

Disposition of Miami liquefier to Pennypacker Capital for $62 million.

Divestiture of remaining 20% Energos stake to Apollo for ~$140 million.

III. INVESTMENT HIGHLIGHTS

A. Strengthening Financial Position

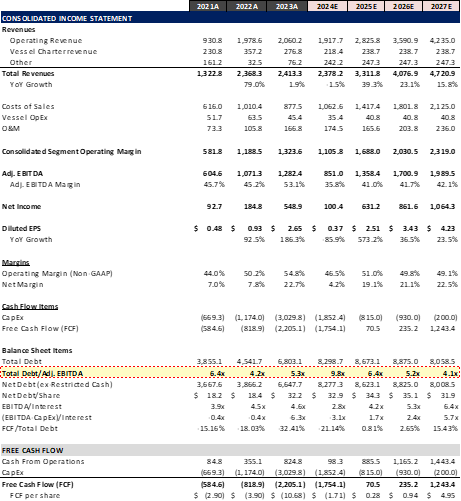

As of Q3 2024, NFE reported $8 billion in total debt (~9.0x+ 2024E Adj. EBITDA). This elevated leverage reflects the company’s aggressive expansion and investment in its proprietary Fast LNG (FLNG) technology. Recognizing the urgency of addressing its capital structure, NFE’s management has implemented a comprehensive plan to strengthen its balance sheet through increased operational cash flow, targeted asset-level financings, and cost optimization.

The commissioning of FLNG1 in mid-2024 is a pivotal milestone that marks the beginning of NFE’s cash flow inflection. FLNG1 is expected to generate approximately $600 million in annual EBITDA, with additional contributions from FLNG2 and FLNG3 as they come online in 2025 and 2026. This operational ramp-up provides the foundation for significant cash flow growth, which is critical for managing debt obligations and funding future initiatives.

To further enhance financial flexibility, NFE is pursuing $1.5 billion in asset-level financing for FLNG1 and an additional $1 billion for its Brazilian operations. These high-performing assets, supported by predictable cash flows, allow the company to refinance corporate-level debt on more favorable terms, reducing financial risk while preserving liquidity. Moreover, with FLNG1 now operational, capital expenditures are expected to decline significantly, freeing up additional cash for reinvestment and debt servicing.

NFE has also prioritized negotiations with FEMA regarding a $659 million settlement related to the early termination of a Puerto Rico power contract. A favorable resolution of this settlement would inject critical liquidity, further supporting the company’s deleveraging efforts and enabling growth investments.

B. The FLNG Advantage: Catalyzing Growth

NFE’s proprietary Fast LNG technology is central to its growth strategy. Unlike traditional land-based liquefaction facilities, FLNG units are modular, cost-effective, and rapidly deployable, enabling NFE to address underserved markets with scalable solutions.

FLNG1, deployed off the coast of Mexico, began operations in 2024. This milestone validates the technology’s effectiveness and positions NFE to achieve significant EBITDA growth in 2025 as additional FLNG units become operational. FLNG2 and FLNG3, both under construction, will further expand NFE’s production capacity, enabling the company to meet increasing global demand for LNG while diversifying its revenue streams.

C. Strategic Split: Unlocking Value Through Focus

In 2025, NFE plans to separate its upstream and downstream operations, creating two distinct entities. This strategic move reflects management’s commitment to unlocking shareholder value by enhancing operational focus and providing greater transparency.

The upstream entity will concentrate on gas procurement and liquefaction, leveraging FLNG technology to drive efficiency and growth. The downstream entity will focus on terminals, power generation, and customer-facing operations. By separating these business segments, NFE aims to provide investors with clearer visibility into each operation's unique risk and growth profiles. This improved transparency is expected to attract a broader investor base and result in higher valuation multiples, aligning NFE with industry peers that have adopted similar strategies.

D. Asset Monetization: Strengthening Liquidity

NFE is exploring additional asset-level financing opportunities, particularly for its FLNG and Brazilian operations. These financings are expected to deleverage the balance sheet further and address the company’s upcoming refinancing needs, including the 2026 notes. The strategic use of asset-backed financing reinforces NFE’s ability to balance growth with financial stability.

E. Leadership Alignment and Vision

CEO Wes Edens’ leadership and significant equity stake in NFE underscore the alignment between management and shareholder interests. In October 2024, Edens purchased nearly six million shares during a $400 million equity offering, signaling his confidence in the company’s future prospects. His active involvement and proven track record in infrastructure development provide reassurance to investors navigating NFE’s near-term challenges.

F. Addressing Challenges and Unlocking Value

In September 2024, New Fortress Energy (NFE) received authorization from the U.S. Department of Energy to export up to 1.4 million tonnes per annum of liquefied natural gas (LNG) from its Fast LNG 1 facility, located offshore Altamira, Mexico, to non-Free Trade Agreement countries for a five-year term. This approval, combined with prior authorization for Free Trade Agreement countries, enables NFE to supply natural gas to markets worldwide, enhancing the marketability of its FLNG 1 asset and supporting its goal of accelerating the global energy transition.

The FEMA settlement remains another key variable. A successful resolution would provide much-needed liquidity and reinforce investor confidence in NFE’s financial stability. Together, these efforts highlight NFE’s proactive approach to mitigating risks while positioning itself for growth.

IV. FINANCIALS & VALUATION

In the third quarter of 2024, NFE reported Adj. EBITDA of $176 million, surpassing both internal and Street estimates. However, due to maintenance on FLNG assets, the company has adjusted its fourth-quarter EBITDA guidance to $200–$220 million. Additionally, contracted volumes in Puerto Rico have led to a revision of 2025 guidance from $2 billion to $1.325 billion.

To further enhance valuation, NFE has engaged advisors to explore potential asset sales, aiming to unlock value and reduce leverage. Peak leverage is anticipated next year, followed by a rapid decline as cash flows increase.

IV. CATALYSTS

Several strategic initiatives and milestones are poised to drive significant value creation for NFE shareholders:

Execution of Strategic Split: The separation of upstream and downstream operations in 2025 will unlock substantial value, enhancing operational focus and transparency.

Achievement of Financing Targets: Successful completion of $2.5 billion in asset-level financings will validate the value of NFE’s assets and strengthen its balance sheet.

Positive Resolution of FEMA Settlement: A favorable outcome would provide critical liquidity, supporting deleveraging and growth initiatives.

Operational Expansion: Continued ramp-up of FLNG1 and the completion of FLNG2 and FLNG3 will drive revenue growth and establish NFE as a leader in the global LNG market.

V. KEY RISKS

New Fortress Energy (NFE) continues to face substantial challenges, including a strained capital structure, permitting delays for its Fast LNG (FLNG) assets, and the unresolved FEMA settlement. While these risks are significant, management has taken steps to mitigate their impact and support the company's long-term objectives.

Capital Structure Challenges

As of Q3 2024, NFE has $8 billion in debt, reflecting an aggressive expansion strategy that has outpaced revenue growth. Delays in ramping up Brazilian operations and higher-than-anticipated construction costs have further strained the company’s financial position, with a debt-to-EBITDA ratio of 9.0x+ emphasizing the need for financial stabilization. The looming refinancing of its 2026 Notes underscores the critical nature of these issues.

FEMA Settlement Uncertainty

NFE’s $373 million sale of two power plants in Puerto Rico to PREPA in early 2024 was accompanied by the early termination of FEMA contracts for operations and gas supply. NFE has filed a revised claim for $659 million. Still, delays in resolving this dispute and ongoing power grid issues in Puerto Rico create uncertainty around the timing and amount of potential payments.

Disclaimer: The author does not guarantee the accuracy or completeness of any information provided. The author does not provide personalized investment advice and the information written is not tailored to the needs of any individual investor; everything written herein is the opinion of the author and is subject to change without notice. There is substantial risk of loss in the investments mentioned and you should consult with your financial advisor whether any investments suit your specific needs. The author may have positions in the investments mentioned and those positions may change without notice.