Historically, investing involved a deep dive into fundamental analysis—examining a company’s products, financials, and management to make informed decisions. The approach was relatively straightforward: find value, buy low, sell high, or short overhyped stocks. However, the landscape has shifted significantly with the growth of multi-strategy funds (“pod shops”), which have brought a more nuanced and complex approach to the market.

In a typical multi-strategy framework, a successful investor typically needs to be able to generate “alpha” while maintaining a low volatility, market neutral portfolio. Buying a “compounder” or “hidden gem”, no matter how thoroughly researched, is not ideal for this mandate. Instead, let’s take long/short equity as an example pod strategy and delve into what would constitute a “good trade.”

Multi-Strategy Investment Process

In a typical long/short equity pod strategy, you might have sector focused analysts who are responsible for a certain coverage universe, such as “Consumer/Retail” companies. Let’s say Analyst #1 has been covering Coca Cola (KO) and PepsiCo (PEP) for many years. As part of the analyst’s research process, they not only model and project the company’s financial statements, speak to management and other Wall Street analysts, but also do deep “channel checks” by talking to purchasers, suppliers, and distributors. In multi-strat land, timing is of the utmost importance and in Analyst #1’s case, she realizes that Wall Street “consensus” estimates are way too optimistic about Coca Cola (KO)’s next quarter earnings per share (EPS) estimate.

Importance of Volatility

If you were an “old school” fundamental Buffett or Greenblatt investor armed with the type of conviction that Analyst #1 had, you might want to short Coca Cola (KO US) stock and call it a day. Unfortunately, for a multi-strategy investor, it’s not the fact that KO will underperform, it’s the fact that the market hasn’t priced in this underperformance yet. Additionally, in order to maintain market neutrality, the pod investor would want to go long another stock like PepsiCo (PEP US) or maybe a basket of consumer/retail stocks or even an index (note: there are ways to backtest which hedge works best).

The “alpha” in this trade is the “variant view” that Analyst #1 has because it will likely cause KO stock to be extremely volatile when it reports earnings. This single stock abnormal volatility is what the long/short equity analyst is trying to capture. In a perfect scenario, KO would miss analyst estimates and decline significantly while PEP (or the applicable “long” hedge) would trade in-line with estimates.

For a long/short equity analyst, “earnings are the catalyst.” Ask any long/short equity analyst and the weeks when earnings are reported are easily the most stressful time of the job. But earnings are typically well researched by many market participants, the dates of the earnings releases are (most of the time) communicated well in advance of the actual reporting date. The repetitive nature of the earnings cycle gives analysts a schedule on which they can heavily rely to do their due diligence and come up with earnings previews and hopefully “variant views” that can lead to volatility and outperformance. But are there other ways to generate returns besides “calling quarters”? Yes.

Event Volatility

According to Google, “In stock market trading, a gap up occurs when a stock's opening price is higher than the previous day's closing price, while a gap down occurs when it's lower. Gaps can be caused by a variety of factors, including news announcements, earnings reports, mergers and acquisitions, economic data releases, and geopolitical events.”

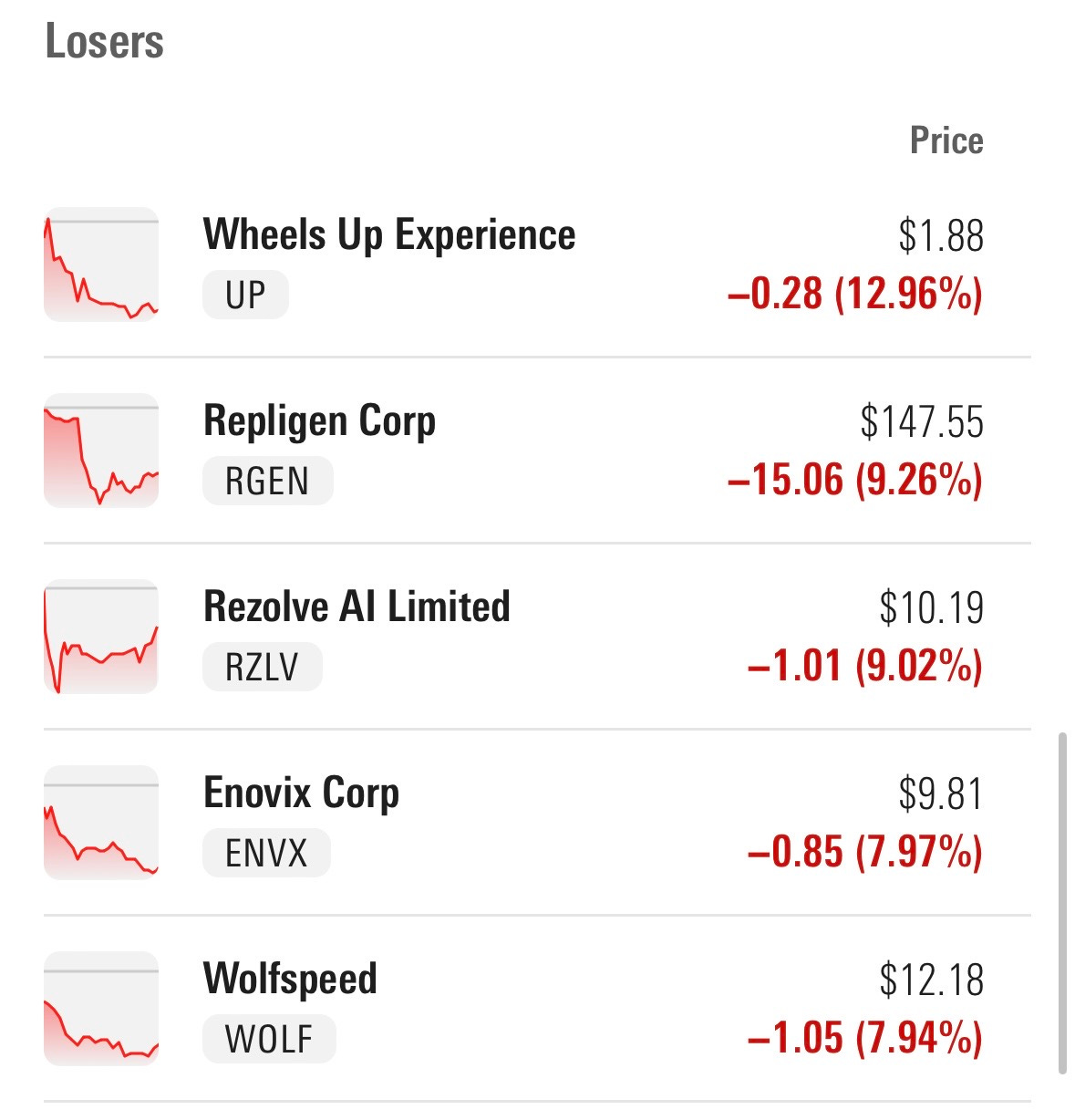

If you type into any search engine “top gainers” or “top losers”, you will likely find a list of the best and worst performing stocks over a certain time period (1 day, 3 days, 1 week, etc.). These are typically stocks that have “gapped up, “gapped down” or experienced some other abnormal intraday move. These kinds of stock-specific gains or losses would lead to significant outperformance in a hedged long/short equity strategy. But what causes these “gaps”? (Note: as an experiment, find a list of daily top 10 gainers and top 10 losers and try to find the main reason for the movement. In addition to earnings surprises, you will likely find legal decisions, FDA approvals, merger announcements, etc.).

As previously discussed, earnings reports are heavily covered by a slew of hedge fund analysts, Wall Street analysts, news organizations, and others who are all competing against each other to generate a “variant view”…but what about the other “gap causing” factors, namely “news announcements, M&A, and geopolitical events”? In addition to earnings, a somewhat less followed strategy called “event-driven” trading, which involves the analysis of company-specific events that may impact the underlying fundamentals of a business: litigation, restructuring, regulatory decisions, mergers and acquisitions, asset sales, debt exchanges, spin-offs, and other corporate actions. These event-driven catalysts, especially if an analyst can establish a “variant view” before becoming definitive (called “soft catalysts”) can also lead to single-stock volatility, and if hedged appropriately, outperformance.

This area of the market (vs. long/short, long-only, index funds, and other traditional equity market participants) seems to be a lot less crowded and more ripe for establishing variant views (note: there are probably significantly more market participants trying to project Apple’s next quarter iPhone shipments than analyzing whether Bayer/Monsanto (BAYN GR) will win its “failure to warn” pre-emption argument before the Supreme Court related to its Roundup chemical labeling practices).

One caveat is that many of the sub-strategies within event-driven require specialized expertise (M&A, legal, antitrust). That being said, it is an exciting space and one to watch as time goes on.

Great read.