Commentary: What's in a Name? Everything Apparently.

On January 31, 2021, Elon Musk tweeted: “On Clubhouse tonight at 10 pm LA time". This tweet set off a frenzy among Musk’s followers to find out exactly what “Clubhouse” was. Was it a publicly traded stock? No, Clubhouse was a Silicon Valley startup that had created a new app that allowed users to gather in audio chatrooms to discuss different topics. Various public figures (including Musk, Drake, Ashton Kutcher, Oprah Winfrey, and others) had been flocking to Clubhouse and the app’s userbase was skyrocketing. According to PitchBook, Clubhouse had raised $100mm led by VC firm Andreessen Horowitz at a $1bn valuation. Cool, but what does this have to do with markets?

What’s interesting is that at the same time that Elon Musk was tweeting about Clubhouse the app, a similarly named company that trades over-the-counter, Clubhouse Media Group (“CMGR”), experienced a sudden abnormal increase in both trading volume and price, pushing its market valuation to over $2bn. Not bad for a 1 employee firm focused on “influencer-based media” whose corporate address matches that of a “virtual office” space in Las Vegas, Nevada. Although one can cast this off as a unique situation, this type of name confusion and subsequent market reaction has been increasingly common (especially due to the growth of social media and the pace at which information is disseminated).

Let’s look at some of the most obvious examples:

(1) Zoom Video Communications (ZM) vs. Zoom Technologies (ZOOM)

Zoom Video Communications (“ZM”), the company behind the popular work-from-home video communications software was one of the main beneficiaries of the various restrictions that were imposed due to COVID-19. In conjunction with the increasing use of its software, its common stock had been steadily climbing. Starting in March 2020 (around the time that COVID-19 was declared a pandemic), Zoom Technologies (“ZOOM”), a 10-person firm also started to experience abnormal trading volume and price increases as investors mistook it for the more well-known Zoom Video Communications. The SEC temporarily halted Beijing-based Zoom Technologies and on April 9, 2020, FINRA, effected a symbol change from “ZOOM” to “ZTNO” to distinguish the two firms and presumably protect unsuspecting investors.

(2) Snap (SNAP) vs. Snap Interactive (STVI)

On March 2, 2017, the owner of the popular Snapchat app, Snap, Inc. (“SNAP”), held its initial public offering. In the days leading up to the SNAP IPO, a similarly named company with a $51mm market cap, Snap Interactive (“STVI”), also experienced abnormal trading volume and price increases.

One can make the argument that all three of the examples above (Clubhouse Media Group, Zoom Technologies, and Snap Interactive) were just lucky beneficiaries of their similarly named larger competitors’ success.

Note: I’m more skeptical of the motives of CMGR which changed its name from Tongji Healthcare in January 2021, well after the Clubhouse app had already started to gain traction.

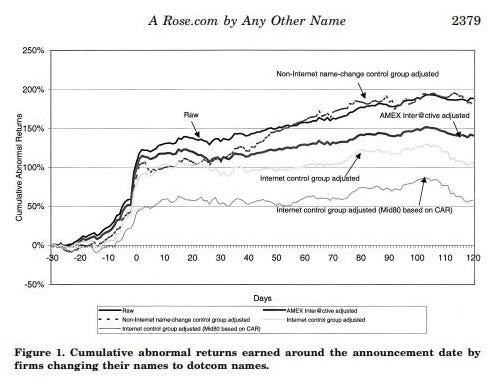

Regardless of whether these examples can be attributed to luck, the ability of what’s included in a corporate name to change the perception of investors has been well-studied over the past 30 years. At no time was this more evident than during the dotcom boom, when simply adding the word “.com” to the end of a corporate name resulted in an immediate positive abnormal return.

In their paper A Rose.com by Any Other Name, the authors found that the “dotcom” name change effect produced cumulative abnormal returns on the order of 74 percent for the 10 days surrounding the announcement day.

In an era marked by ever-changing investment fads, market prices that are diverging more and more from their underlying fundamental value, and a Long Island, NY-based iced tea company that can go up 3x by simply changing its name to “Long Bitcoin,” investors should pause and take the time to understand what they are a purchasing before pressing the “buy” button.

Disclaimer: The author does not guarantee the accuracy or completeness of any information provided. The author does not provide personalized investment advice and the information written is not tailored to the needs of any individual investor; everything written herein is the opinion of the author and is subject to change without notice. There is substantial risk of loss in the investments mentioned and you should consult with your financial advisor whether any investments suit your specific needs. The author may have positions in the investments mentioned and those positions may change without notice.